Educator Expenses 2025. The internal revenue service has long allowed educators to deduct part of the cost of supplies and other expenses from their taxes. You work at least 900.

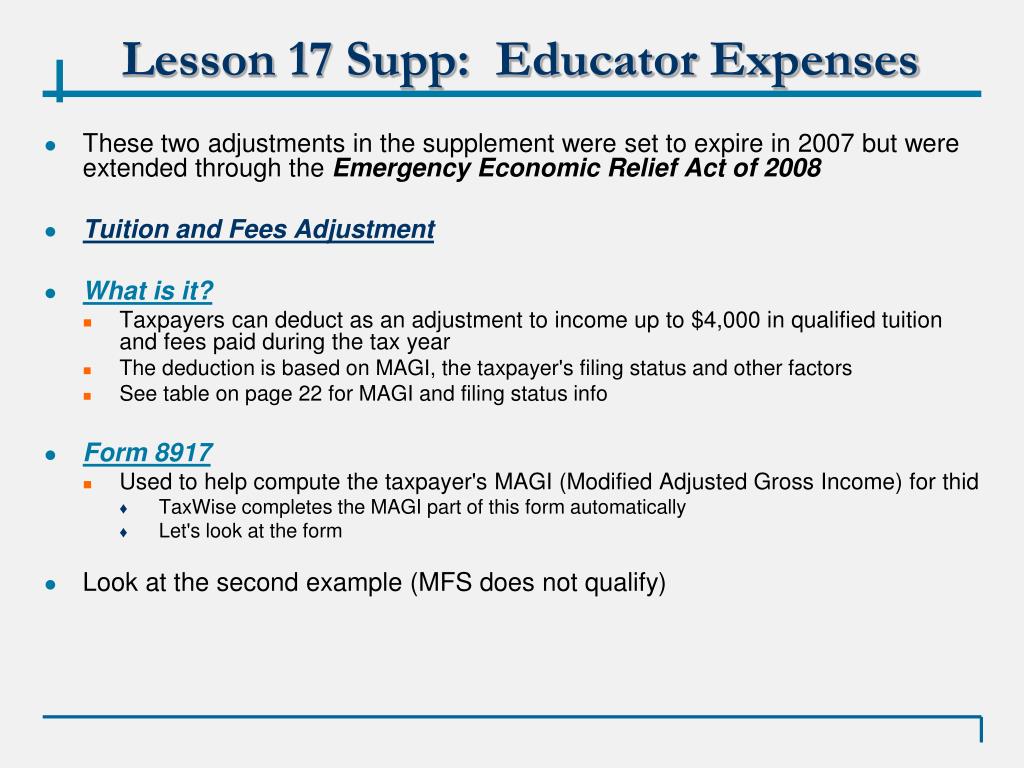

Now, for 2018 through 2025, the tcja has suspended miscellaneous itemized deductions subject to the 2% of agi floor. The educator expense deduction has been increased for this year.

These include unreimbursed qualified expenses of up to $300 ($600 for joint filers if both fall under this category).

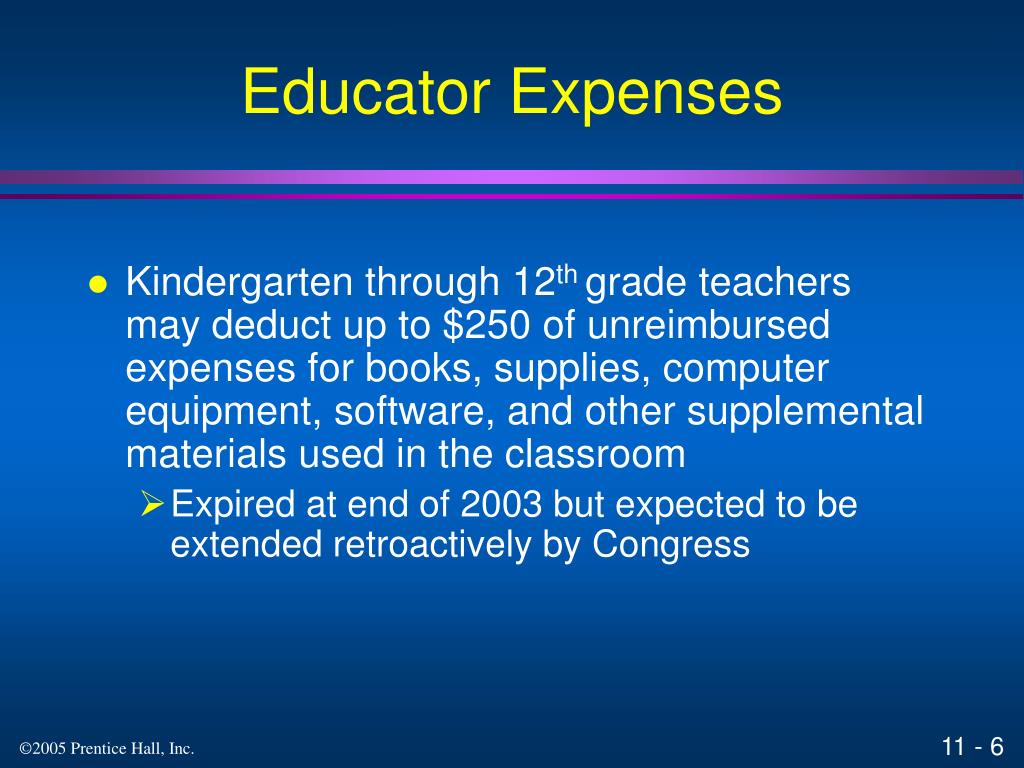

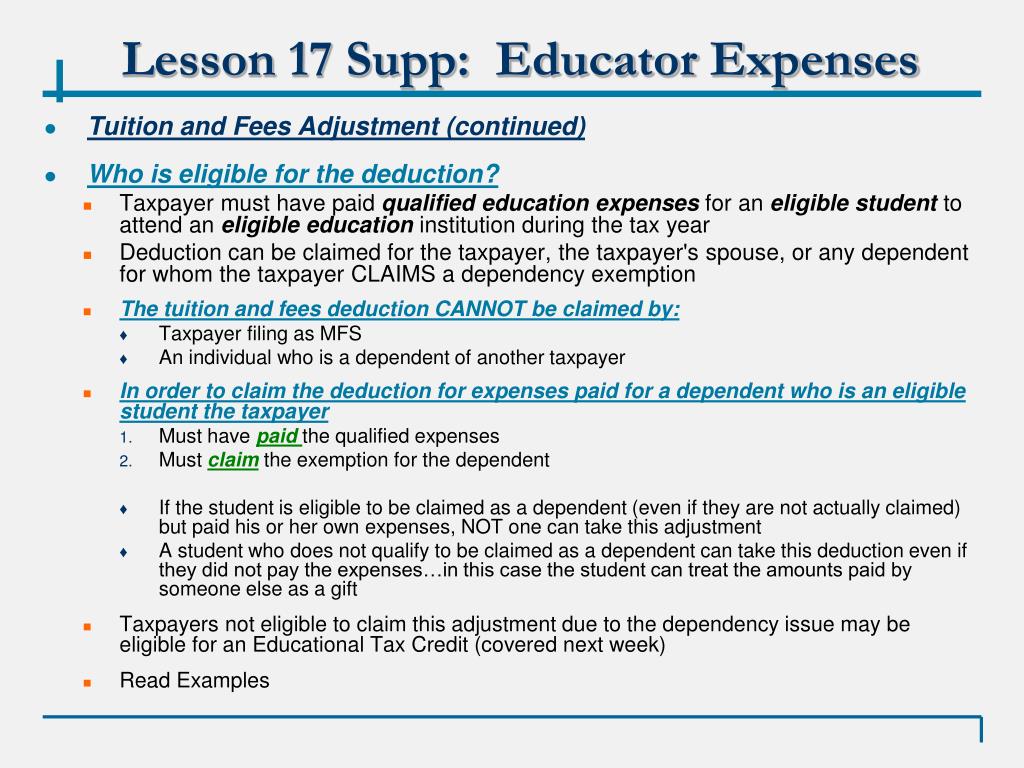

PPT Taxation of Individuals PowerPoint Presentation, free, You work at least 900. As places that help young people form their attitudes and beliefs about others, schools can play a powerful role in helping to break down the same psychological.

What is the Educator Expense Deduction? Hollis Lewis CPA, According to the irs, eligible teachers can deduct up to $300 ($600 if married to another teacher and you are filing. According to form 1040 instructions, educator expenses are enabled up to $250 per taxpayer on form 1040, schedule 1, line 23.

Tax Deductions for Teachers Educator Expenses Money Instructor, The educator expense deduction has been increased for this year. Any amount over $250 will carry.

PPT VITA 01/17/09 Lesson 17 Supplement Educator Expenses and, The educator expense deduction has been increased for this year. Examples of expenses that educators can deduct include books,.

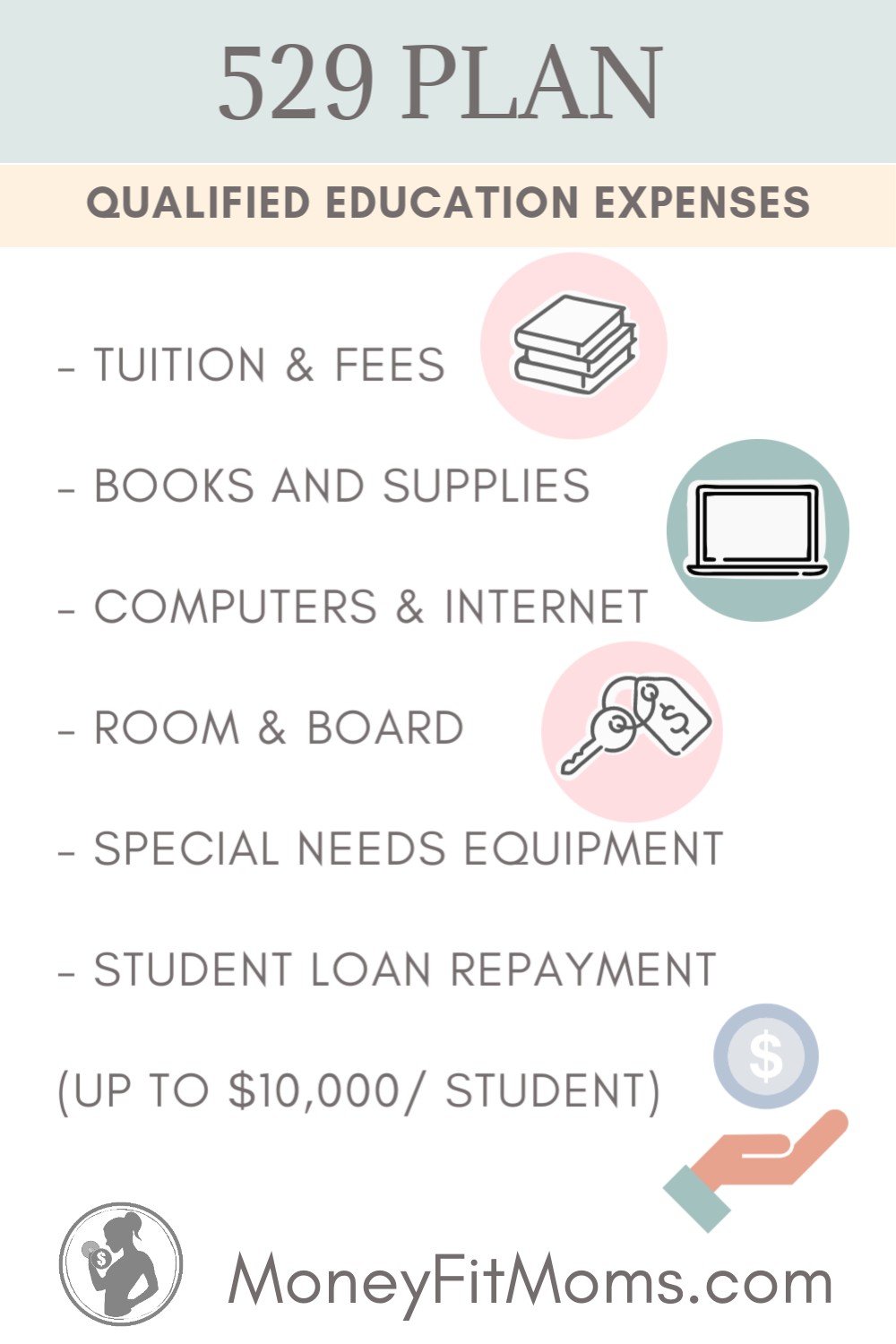

How to Maximize College Savings with a Savvy 529 Plan, According to form 1040 instructions, educator expenses are enabled up to $250 per taxpayer on form 1040, schedule 1, line 23. Your main objective is to improve the learning experience of the kids, but there.

Educator Expense Deduction Eligibility, Limits & How to Claim, Any amount over $250 will carry. Now, for 2018 through 2025, the tcja has suspended miscellaneous itemized deductions subject to the 2% of agi floor.

The Cost of the College of Cost The Cost of Your Future, What is the educator expense deduction? These include unreimbursed qualified expenses of up to $300 ($600 for joint filers if both fall under this category).

PPT VITA 01/17/09 Lesson 17 Supplement Educator Expenses and, You are an eligible educator if, for the tax year, you meet the following requirements: Any amount over $250 will carry.

Educator Expenses Deduction on Form for Federal Tax Return and, From 2018 through 2025, the tcja has suspended miscellaneous itemized deductions subject to the 2% of adjusted gross income (agi) floor. The educator expense deduction has been increased for this year.

Financial costs and benefits of college Importance of college Khan, What is the educator expense deduction? Any amount over $250 will carry.

Jct estimated that the cost of the modification and permanent extension of this deduction would be $2.9 billion over 10 years (between 2016 and 2025).

Wr Separation Stats 2025. Each week, i'll be tackling nfl's next gen stats, bringing you data from the previous week's games with notable takeaways you […]

Nivel De Pobreza En Estados Unidos 2025. Aun así, el dato es ligeramente superior al que. Un sitio web.gov pertenece a una organización oficial del […]

What Is The Smartest Dog Breed 2025. When it comes to intelligence, it’s important to know which dog breeds are smart and trainable. Discover if […]